Articles

-

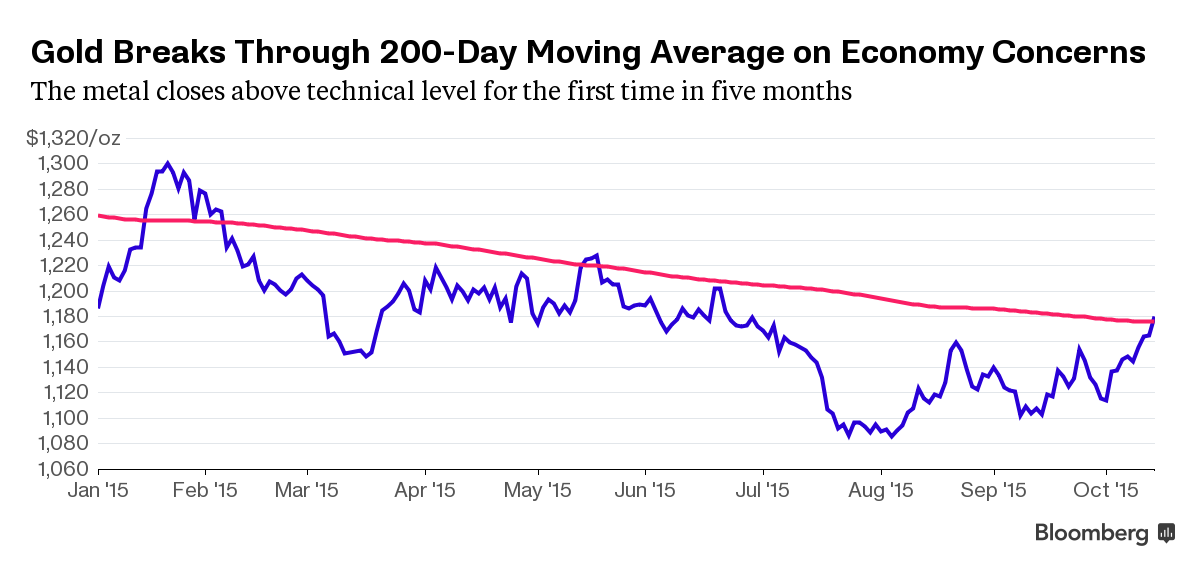

Gold Comes Back to Life as Prices Exceed 200-Day Moving Average

Gold is starting to shed its reputation as a dead asset, and bulls can thank signs the U.S. economy is starting to sputter for the boost.

The metal was little changed at $1,184.18 an ounce by 10:28 a.m. in London after climbing above its 200-day moving average on Wednesday for the first time in about five months. Prices touched the highest since June 22 yesterday and investors bought the most through gold-backed funds since August.

A gauge of U.S. inflation fell by the most since January and retail sales missed forecasts, increasing traders’ bets the Federal Reserve will delay raising rates until next year. That’s good news for gold, which loses out when borrowing costs rise because the metal doesn’t pay yields, unlike competing assets.“The last couple of the months we’ve seen a real sort of deterioration in U.S. data and a realization by the market that the Fed probably missed its window to hike in 2015,” Jordan Eliseo, chief economist at trader Australian Bullion Co. in Sydney, said by phone. “That’s obviously scared a few investors who were short gold out of their positions.” The market’s strength and better technical picture are also encouraging some investors to go long, he said.

Investors now see about even odds of that rates will increase by April next year, with the chance of liftoff this month plunging to 4 percent from 10 percent in just 24 hours, futures trading shows. Gold surged 70 percent from December 2008 through June 2011 as the U.S. central bank fanned inflation fears by purchasing debt and holding borrowing costs near zero percent in a bid to shore up growth.

Read full article